Your Bernie sanders tax math images are ready. Bernie sanders tax math are a topic that is being searched for and liked by netizens today. You can Find and Download the Bernie sanders tax math files here. Get all free photos.

If you’re searching for bernie sanders tax math images information related to the bernie sanders tax math topic, you have visit the ideal site. Our website frequently provides you with suggestions for downloading the maximum quality video and image content, please kindly search and locate more enlightening video content and graphics that fit your interests.

Bernie Sanders Tax Math. Sanders has proposed several options to help cover the cost of Medicare for All including raising taxes to 52 for incomes above 10 million. Bernie Sanders wants free health care for all and was asked how he would pay for it. Comrade Bernie Sanders SenSanders February 3 2022 According to US tax code and data from the Labor Department the average nurse earns 75000 in income each year. The first is a 22 percent income tax levied on a households taxable income adjusted gross income minus deductions and exemptions.

Medicare has no profit so its at best partial reimbursement and semi-pro bono. The first is a 22 percent income tax levied on a households taxable income adjusted gross income minus deductions and exemptions. Sanders has proposed several options to help cover the cost of Medicare for All including raising taxes to 52 for incomes above 10 million. Another option is a 4 income-based premium paid by households. But he has never suggested that. Layer all of these taxes on top of each other without regard to policy interactions economic.

According to Sanders math the plan.

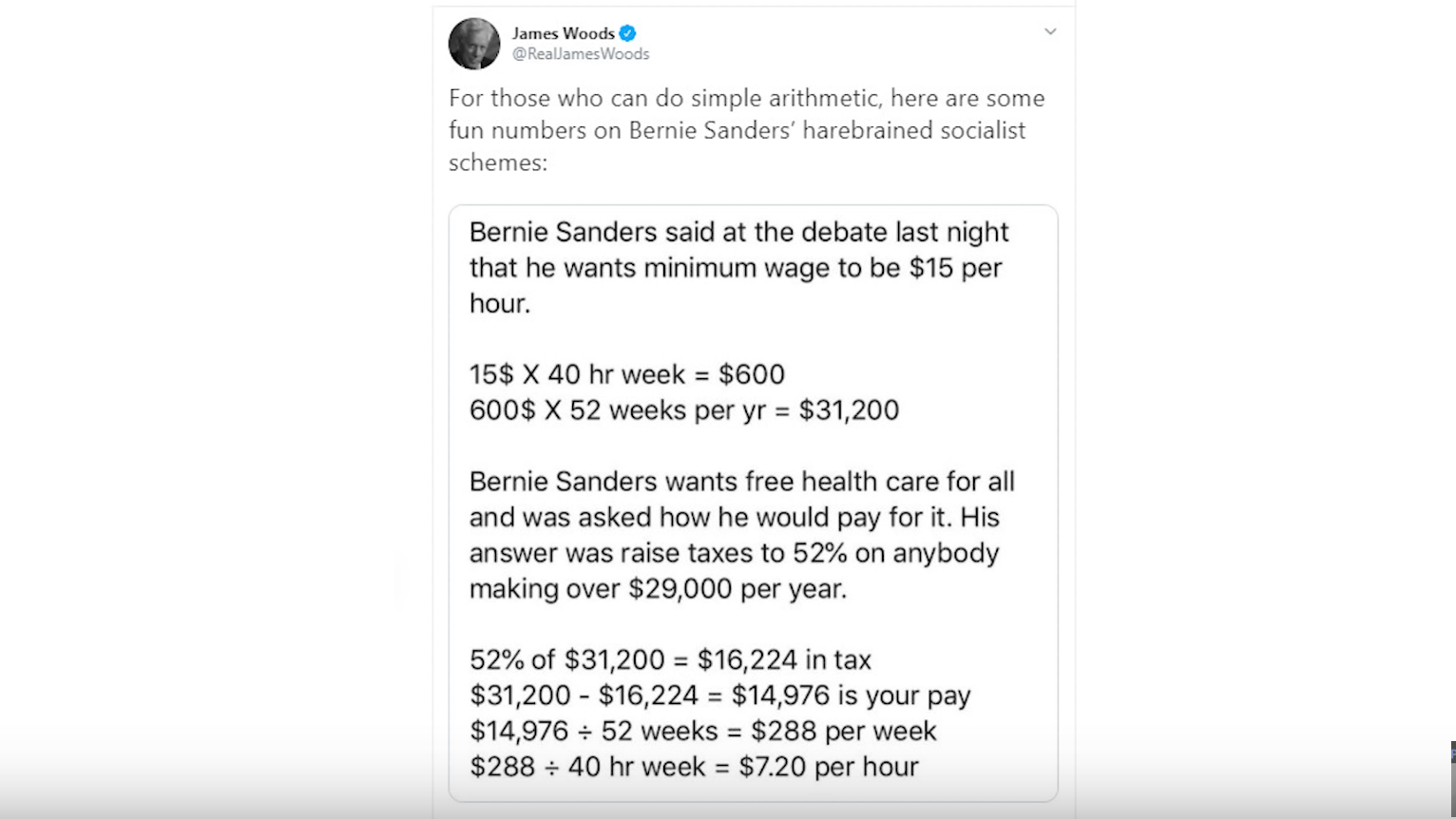

Another option is a 4 income-based premium paid by households. Bernie Sanders said at the debate last night he wants minimum wage to be 15 an hour. ReBernie Sanders tax rate. Comrade Bernie Sanders SenSanders February 3 2022 According to US tax code and data from the Labor Department the average nurse earns 75000 in income each year. Sanders has proposed several options to help cover the cost of Medicare for All including raising taxes to 52 for incomes above 10 million. Bernie Sanders plan would raise 26 trillion over the 10-year period from 2020-2029.

Source: forbes.com

Source: forbes.com

15 x 40 hr work week 600 600 x 52 weeks per year 31200 Bernie Sanders wants free healthcare for all. Elizabeth Warrens proposal would raise about 22 trillion and Sen. Jamie Dimons message to Bernie Sanders The memo contains basic arithmetic errors such as claiming a half-percent tax on 25 billion worth of trading would generate 125 billionas opposed to. Bernie Sanders wants free health care for all and was asked how he would pay for it. Another option is a 4 income-based premium paid by households.

Source: twitter.com

Source: twitter.com

The numbers simply do not add up. Two others a new 62 percent payroll tax on employers and a 22 percent income-related premium would apply to all workers. Using the Tax Foundations wealth tax model and after factoring in the macroeconomic feedback effects we estimate that Sen. Back to top Reply. The second is a 02 percent payroll tax levied on all wages and salaries earned by a household.

Bernie Sanders is upset about the delays to the 35 trillion reconciliation bill. Layer all of these taxes on top of each other without regard to policy interactions economic. Tax Returns Sanders Releases 10 Years of Tax Returns 9 Months Before Caucuses Primaries Begin. Bernie even thanked the Koch brothers for doing the math for him. Medicare has no profit so its at best partial reimbursement and semi-pro bono.

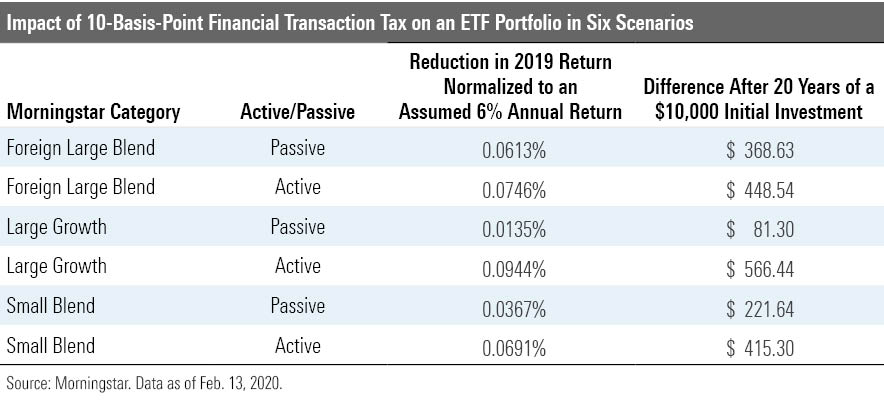

Source: morningstar.com

Source: morningstar.com

Finally impose a carbon tax Bernie Sanders 8 percent wealth tax and his 77 percent estate tax. Two others a new 62 percent payroll tax on employers and a 22 percent income-related premium would apply to all workers. And he wants to raise the fed. Another option is a 4 income-based premium paid by households. The release nine months before the first votes are cast.

Source: capx.co

Source: capx.co

52 of 31200 16224 in tax 31200 - 16224 14976 is your pay 14976 52 weeks 288 per week 288 40 hr week 720 per hour Math. 15 x 40 hr work week 600 600 x 52 weeks per year 31200 Bernie Sanders wants free healthcare for all. According to Sanders math the plan. But he has never suggested that. Two others a new 62 percent payroll tax on employers and a 22 percent income-related premium would apply to all workers.

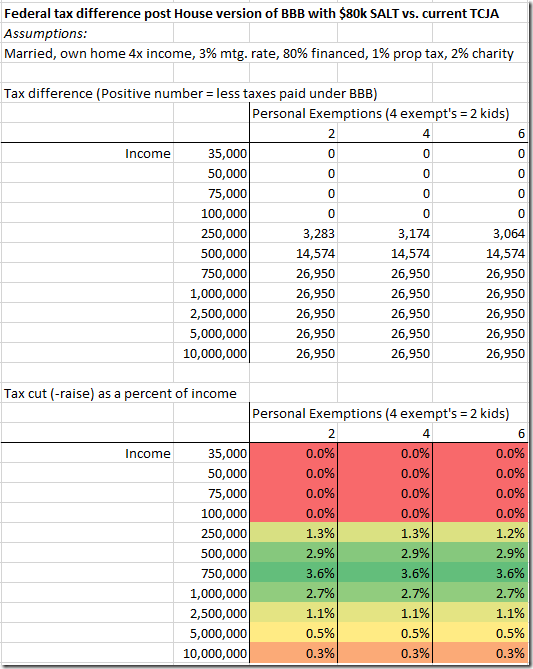

Source: spreadsheetsolving.com

Source: spreadsheetsolving.com

That money would be taxed at a 22 rate totaling 16500. Some of these levies like a higher tax rate on large estates would fall exclusively on the wealthy. Voluntary disclosure follows nearly 30 years of annual financial disclosures. But he has never suggested that. The numbers simply do not add up.

Source: vox.com

Source: vox.com

The Poynter Institute. It only works because the rest of us pay extra for our care to make up the elderlys costs. The Democratic Party has been tearing itself to pieces debating whether its latest reconciliation bill should spend 35 trillion or 2 trillion or even 15 trillion. Sanders plan math problems. Medicare has no profit so its at best partial reimbursement and semi-pro bono.

Finally impose a carbon tax Bernie Sanders 8 percent wealth tax and his 77 percent estate tax. And he wants to raise the fed. His answer was raise taxes to 52 on anybody making over 29000 per year. Less noticed but perhaps more important has been the quiet death of the progressives bold tax the rich utopia. Layer all of these taxes on top of each other without regard to policy interactions economic.

Source: snopes.com

Source: snopes.com

The release nine months before the first votes are cast. A person earning a billion dollars would pay a 37 tax rate totaling approximately 350000000 after deductions. That money would be taxed at a 22 rate totaling 16500. Thats a savings of 1 trillion over the current system. Layer all of these taxes on top of each other without regard to policy interactions economic.

To provide the remaining financing Sanders would seek new taxes. The first is a 22 percent income tax levied on a households taxable income adjusted gross income minus deductions and exemptions. Two others a new 62 percent payroll tax on employers and a 22 percent income-related premium would apply to all workers. Tax Returns Sanders Releases 10 Years of Tax Returns 9 Months Before Caucuses Primaries Begin. Bernie even thanked the Koch brothers for doing the math for him.

Source: forbes.com

Source: forbes.com

For example he has proposed a wealth tax. Tax Returns Sanders Releases 10 Years of Tax Returns 9 Months Before Caucuses Primaries Begin. This 45 percent tax rate would gradually rise to 77 percent on estates valued at 1 billion or more. Bernie Sanders is unsurprisingly bad at math. Back to top Reply.

Source: medium.com

Source: medium.com

Layer all of these taxes on top of each other without regard to policy interactions economic. Using the Tax Foundations wealth tax model and after factoring in the macroeconomic feedback effects we estimate that Sen. Sanders has proposed several options to help cover the cost of Medicare for All including raising taxes to 52 for incomes above 10 million. 15 x 40 hr work week 600 600 x 52 weeks per year 31200 Bernie Sanders wants free healthcare for all. Elizabeth Warrens proposal would raise about 22 trillion and Sen.

His answer was raise taxes to 52 on anybody making over 29000 per year. Bernie Sanders wants free health care for all and was asked how he would pay for it. ReBernie Sanders tax rate. Bernie Sanders plan would raise 26 trillion over the 10-year period from 2020-2029. Finally impose a carbon tax Bernie Sanders 8 percent wealth tax and his 77 percent estate tax.

Source: breakingviews.com

Source: breakingviews.com

The numbers simply do not add up. The numbers simply do not add up. We need a massive reform of the tax code. 52 of 31200 16224 in tax 31200 - 16224 14976 is your pay 14976 52 weeks 288 per week 288 40 hr week 720 per hour Math. Elizabeth Warrens proposal would raise about 22 trillion and Sen.

Source: twitter.com

Source: twitter.com

I voted for Bernie in the primary and yes that bothers me. Bernie Sanders plan would raise 26 trillion over the 10-year period from 2020-2029. For example he has proposed a wealth tax. Finally impose a carbon tax Bernie Sanders 8 percent wealth tax and his 77 percent estate tax. The Sanders tax plan includes two new taxes that would be paid directly by a household making 36841 a year.

Source: snopes.com

Source: snopes.com

The Democratic Party has been tearing itself to pieces debating whether its latest reconciliation bill should spend 35 trillion or 2 trillion or even 15 trillion. It only works because the rest of us pay extra for our care to make up the elderlys costs. The second is a 02 percent payroll tax levied on all wages and salaries earned by a household. Comrade Bernie Sanders SenSanders February 3 2022 According to US tax code and data from the Labor Department the average nurse earns 75000 in income each year. And he wants to raise the fed.

To provide the remaining financing Sanders would seek new taxes. It only works because the rest of us pay extra for our care to make up the elderlys costs. Bernie Sanders said at the debate last night he wants minimum wage to be 15 an hour. This 45 percent tax rate would gradually rise to 77 percent on estates valued at 1 billion or more. Tax Returns Sanders Releases 10 Years of Tax Returns 9 Months Before Caucuses Primaries Begin.

Source: twitter.com

Source: twitter.com

This 45 percent tax rate would gradually rise to 77 percent on estates valued at 1 billion or more. Bernie Sanders is upset about the delays to the 35 trillion reconciliation bill. Its as much a math problem as a political one. Voluntary disclosure follows nearly 30 years of annual financial disclosures. Bernie Sanders I-Vt wants to raise tax rates on wealthy Americans.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bernie sanders tax math by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.